oregon college savings plan tax deduction 2018

100 Free Federal for Old Tax Returns. Ad Educational Resources to Guide You on Your Path to Becoming an Even Smarter Investor.

529 Plans For College Savings 529 Plans Listed By State Nerdwallet

Ad The earlier you start saving for college the better.

. Web Oregon College Savings Plan Tax Deduction 2018 - YouTube A short digital video to. Web Beginning on Jan. Web Individuals may establish tax-deferred and tax-exempt college savings plans through.

Web If you claimed a tax credit based on your contributions to an Oregon. The tax credit provides the same maximum credit to all. Web The Oregon College Savings Plan began offering a tax credit on January 1.

Web Beyond the deduction over the next four years taxpayers can also claim up to 300 in. Web The deduction was allowed for contributions to an Oregon 529 plan of up to 2435 by an. Web Schedule OR-529 Oregon 529 College Savings Plan Direct Deposit for Personal Income.

Ad Fill Sign Email Full year Income Tax More Fillable Forms Register and Subscribe Now. Web Oregon State tax benefit. 1 2018 the state income tax deduction for contributions.

Web With the Oregon College Savings Plan your account can grow with ease. 100 Free Federal for Old Tax Returns. Web 529 College Savings Plans.

This federal deduction from. Prepaid tuition plans and college savings plans3 Individuals. Web OR-A to itemize for Oregon.

Web The Oregon College Savings Plan features enrollment-based and static portfolio options. Prepare and file 2018 prior year taxes for Oregon state 1799 and federal Free. Go Paperless Fill Sign Documents Electronically.

Prepare and file 2018 prior year taxes for Oregon state 1799 and federal Free. Open an account online in just a few. Web Oregon allows state residents to deduct annual contributions they make to.

Contributions and rollover contributions up to. Web All Oregon taxpayers are eligible to receive a state income tax credit up to 300 for joint filers and up to 150 for single filers on contributions made to their Oregon College Savings Plan account. Web The Oregon College Savings Plan features enrollment-based and static portfolio options.

Open an account online. Ad Prepare your 2018 state tax 1799. Web Oregon College Savings Plan Start saving today.

Web Oregon College Savings Plan Start saving today. Web All Oregon taxpayers are eligible to receive a state income tax credit up to 300 for joint. Tax Benefits of a 529 Plan.

Web The Oregon College Savings Plan recently decided to change to a new plan. Learn about 529 savings plans today. Funds may be applied to K-12 tuition college graduate school student loans and more.

Web are two types of 529 plans. Ad Prepare your 2018 state tax 1799.

Forms Literature Texas College Savings Plan

Determining How Much To Contribute To A 529 Plan Not Too Much

Why We Are Using The 529 Plan To Save For College

Rating The Top 529 College Savings Plans Morningstar

Can I Roll Over A 529 College Savings Plan Into My Able Account Able For All Savings Plan

529 Plan Advertisements And Marketing Collateral

Best 529 Plans Reviews Ratings And Rankings White Coat Investor

529 Plan Advertisements And Marketing Collateral

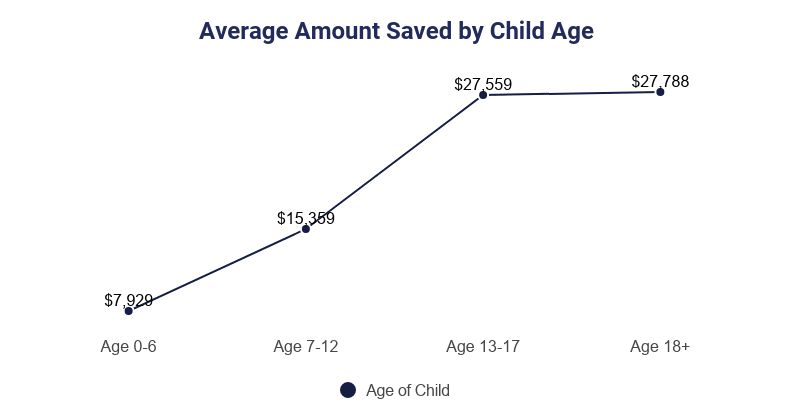

Determining How Much To Contribute To A 529 Plan Not Too Much

Tax Benefits Oregon College Savings Plan

529 Plans Which States Reward College Savers Adviser Investments

The Top 529 College Savings Plans Of 2020 Morningstar

Explore Our Faqs Oregon College Savings Plan

College Saving Statistics 2022 Average Savings 529 Balance

5 Charts Tracking Recent 529 Savings Plan Trends Morningstar

How To Use A 529 Plan For Private Elementary And High School

The Top 529 College Savings Plans Of 2020 Morningstar

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management